Abundance closes largest investment to date for Orbital Marine Power, raising £7 million

10.01.2019

- Orbital Marine Power (Orkney) will fund construction of the UK’s first floating tidal stream turbine to go into commercial production.

- c2,300 individual investors invested an average of c£3,000, with over half investing via their ISAs for a tax-free return.

- Particularly strong support from investors in Scotland, investing the highest average amount at £4,500 each.

- Full £7 million target achieved on January 1st, getting green investment sector off to a great New Year.

- First green finance bond to realise the new maximum crowdfunded investment offer amount without a prospectus of £7m.

2019 looks set to be a top year for green and social investment as the UK’s leading peer-to-peer ethical investment company Abundance starts the year closing its largest fund raise to date, raising £7 million for innovative Scottish tidal energy company Orbital Marine Power (Orkney).

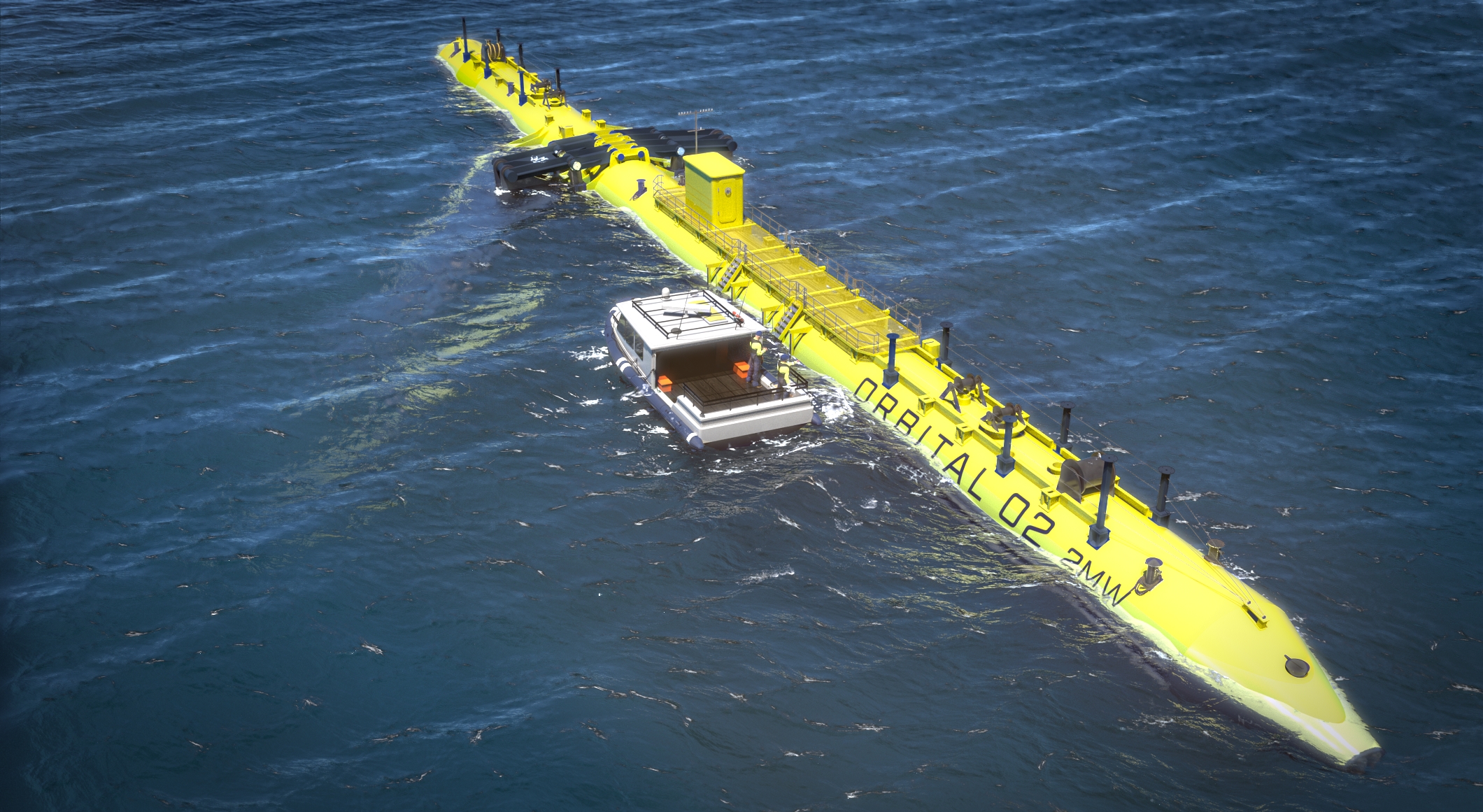

Orbital Marine Power (formerly Scotrenewables Tidal Power) will use the funds raised to build its first production model Orbital O2 2MW turbine, an innovative floating tidal turbine platform that can be towed, installed and easily maintained. The project already has secured a number of supporting grants as well as equity funding, including from the Scottish Government.

© Orbital Marine Power

© Orbital Marine Power The Abundance offer of 2.5-year debentures with an annual return of 12% attracted 2,278 individual investors, with over half investing via an Innovative Finance ISA for a tax-free return. The average investment was approximately £3,000, with the project attracting particularly strong interest from investors in Scotland who put in 50% more on average, at £4,500.

Bruce Davis, co-founder and joint Managing Director, Abundance, said: “2019 promises to be the best year yet for the environmental and social investment sector, and it feels significant that our largest investment to date reached its £7 million target on New Year’s Day. The UK can rightly claim to be a world leader in tidal generation technology and our customers have backed it enthusiastically.”

With this new investment, Orbital Marine Power plans to build its Orbital O2 2MW turbine over the next 12 months, for deployment at Orkney’s European Marine Energy Centre (EMEC) during 2020. The Orbital O2 turbine comprises a 73m-long floating superstructure, supporting two 1MW turbines on either side. The new turbine will draw upon the success of Orbital’s SR2000 turbine which was launched in 2016 and produced in excess of 3GWh of electricity over its initial 12 month test programme at EMEC.

Orbital’s floating turbine simplifies installation and maintenance as risky underwater operations can be avoided, keeping costs and downtime low, while floating systems can be deployed over a wide range of tidal sites in UK and global waters.

Andrew Scott, CEO, Orbital Marine Power, said: “We are delighted with this funding result; it’s a terrific endorsement of our technology and a clear signal that the UK public is hugely supportive of seeing tidal energy brought into the domestic and global energy mixes. The whole team at Orbital Marine are excited to be moving forwards with this flagship project and deliver the first O2 unit for costs similar to offshore wind and so provide the basis for a new and sustainable industry. This a journey we are now honoured to be taking with thousands of new investors, thanks to Abundance.”

Bruce Davis added: “From those who invest the minimum of just £5 to larger investors with tens of thousands to put to work in the green and social economy, each and every one of our customers is playing a part in building a better world while helping achieve their own life goals. We’ve got an exciting pipeline of new investments in a wide range of projects and technologies coming up this year. Expect to see more larger offers like this one as issuers take advantage of the change in EU rules on crowdfunding prospectus limits.”

Abundance also recently closed a wind energy investment, E2 Energy, a 16-year investment in a portfolio of farm-scale wind turbines paying an annual return of 5%, which raised £2.9 million.

Currently open for investment is CoGen Limited, a debenture offer for the UK’s leading developer of waste gasification facilities, which seeks to tackle the UK’s dual problems of waste and the need for lower carbon energy. The 4.5-year debenture paying 10% a year launched shortly before Christmas, and has already raised over £1.2 million, 40% of its minimum target. Find out more: https://www.abundanceinvestment.com/investments/cogen